In the throes of the COVID-19 pandemic, while the world grappled with the human toll, another casualty remains largely unseen: Australia’s small businesses. These enterprises, often the heartbeat of our economy, are enduring unprecedented challenges that threaten not just their survival but the very essence of our communities.

Small businesses are the engines of economic growth, accounting for a significant portion of employment and fostering innovation. They are the corner cafes where locals gather, the boutiques offering unique treasures, and the family-run shops that give our neighbourhoods character.

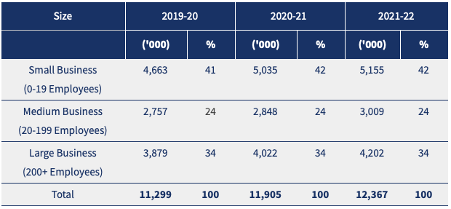

According to the Australian Bureau of Statistics, small business (defined by those employing 0-19 staff), employed over $5million people, which is 42% of the private workforce in 2021-22.

A Perfect Storm

A perfect storm looms on the horizon as Australia faces a dramatic fall in its small business sector. As of June 30, 2023, the country boasted nearly 2.6 million businesses, comprising approximately one small business for every ten individuals.

The top five industries, including construction, professional services, real estate, transport and warehousing, and healthcare and social assistance, painted a diverse economic landscape. However, amidst this diversity, signs of trouble emerge. Healthcare experienced notable growth, while administrative services and retail trade faced decline, signalling an impending crisis. Of these 2.6 million businesses, a staggering 97.3% are classified as small businesses, responsible for a substantial portion of job creation and economic activity.

With over 5 million jobs provided by the small business sector, their significance cannot be overstated. Yet, despite their pivotal role, many small businesses grapple with profitability, with over 40% failing to turn a profit, and approximately 75% of owners earning less than the average wage.

Post Lockdown – Business and the wider public

However, since the onset of the pandemic and beyond, these resilient entities have faced an uphill battle.

Lockdowns, social distancing measures, and economic uncertainty have battered small businesses relentlessly. According to recent statistics, over 100,000 small businesses across Australia have permanently closed their doors since the pandemic began, representing a staggering loss of livelihoods and dreams. Countless others teeter on the brink of collapse, grappling with dwindling revenues, mounting debts, and uncertain futures.

Behind each closure lies a story of perseverance and sacrifice. Consider the small restaurant that once bustled with diners but now sits empty, its owners facing bankruptcy and its employees out of work. Reflect on the local bookstore struggling to compete with online giants, fighting to keep its shelves stocked and doors open. These are not mere statistics; they are human stories of resilience and tenacity in the face of adversity.

The toll on mental health is equally concerning. Small business owners navigate a minefield of uncertainty, shouldering the weight of financial burdens and the responsibility of supporting their families and employees.

Anxiety, depression, and burnout have become all too common, as sleepless nights blur into endless days of financial juggling and tough decisions.

Moreover, the ripple effects extend far beyond individual businesses, reverberating throughout the entire supply chain. Suppliers, contractors, and service providers all feel the impact, amplifying the economic fallout and exacerbating systemic vulnerabilities.

Public Confidence at a low point.

In recent years, Australia has experienced a notable decline in consumer spending, marking a significant shift in economic dynamics with profound implications for small businesses across the country.

This downturn in consumer expenditure, driven by a variety of factors including economic uncertainty, shifting consumer preferences, and the impact of the COVID-19 pandemic, has sent shockwaves through the retail landscape, leaving small businesses particularly vulnerable to the ensuing challenges.

Cost of Living Crisis

One of the primary drivers of the decline in consumer spending is the economic uncertainty that has gripped the nation. Uncertainty surrounding factors such as job security, wage growth, and housing affordability has led many Australian households to adopt a more cautious approach to their finances. As a result, discretionary spending on non-essential goods and services has taken a hit, with consumers opting to prioritize essential purchases and savings over ?? or leisure activities.

In a nutshell, households are grappling with financial insecurity, widening social inequalities, and deepening divisions within society.

Small Business is the heartbeat of our communities

Furthermore, the erosion of small businesses threatens the very fabric of our communities. These enterprises are more than just places of commerce; they are hubs of social interaction, fostering connections and a sense of belonging.

Their disappearance leaves behind voids that cannot be filled by corporate giants or online marketplaces.

It is imperative that we recognize the gravity of the situation and take decisive action. Government support measures, while commendable, must be expanded and targeted to ensure the survival of small businesses.

Financial assistance, rent relief, and tax incentives are critical lifelines that can help keep doors open and keep the lights on.

A United Australia

Equally important is a shift in consumer behaviour. We must prioritize local businesses over convenience and corporate giants, recognizing the value they bring to our communities.

Every dollar spent at a small business is an investment in our collective future, preserving jobs, fostering innovation, and safeguarding the unique character of our neighbourhoods.

Moreover, we must address the systemic inequities that have exacerbated the impact of the pandemic on small businesses.

In recent years, business lending in Australia has surged, underscoring the resilience and determination of small business owners amidst economic fluctuations. However, as interest rates rise, it becomes increasingly critical for policymakers to enact measures that support the growth and sustainability of these enterprises.

To champion small businesses effectively, policymakers must prioritize several key initiatives:

- Lower Taxes: Reducing corporate tax rates and easing regulatory burdens will allow small businesses to reinvest resources into expansion, job creation, and improved wages.

- Regulatory Relief: Simplifying regulatory processes empowers business owners to focus on core operations, fostering agility and innovation.

- Access to Capital: Enhancing access to financing options enables small businesses to invest in growth, research, and workforce development.

- Training & Development: Supporting vocational training programs and apprenticeships ensures a skilled workforce that can adapt to evolving industry demands.

- Free Market Competition: Promoting fair competition encourages innovation and enhances product and service quality.

- Balanced Trade Policies: Implementing fair trade policies protects Australian businesses and facilitates global competitiveness.

- Infrastructure Investment: Modernizing transportation and digital infrastructure improves market access and supply chain efficiency.

In the face of adversity, resilience is our greatest asset. Small businesses have weathered storms before, and with the right support, they can emerge from this crisis stronger than ever. However, time is of the essence, and decisive action is needed to stem the tide of closures and preserve the soul of our economy.

As we navigate the uncertain terrain ahead, let us remember the indomitable spirit of small business owners – the unsung heroes of our economy. Their resilience, innovation, and passion are the bedrock upon which our communities are built. It is incumbent upon us all to ensure that their voices are heard, and their contributions honoured, lest we risk losing the very essence of what makes Australia great.

About Tony Dimitriadis:

Tony Dimitriadis is a respected Australian Accountant and Business Advisor with a passion for supporting small businesses. With over 20 years of experience in the field, Dimitriadis is dedicated to empowering entrepreneurs and fostering economic growth across Australia.

Insert contact